Table of Content

One way to get the jump on paying taxes or just checking that you’re paying the right amount in federal taxes is to use a tax calculator. Deducting expenses for working from home can get complicated and an experienced financial advisor can be a great help. SmartAsset’s free toolmatches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you.

It is important to note that not all items you buy for an office are deemed essential. An armchair or sofa, for example, is not furniture that would be eligible for deductions. These may be added for aesthitics, but they’re not directly for work related use. Employees generally can’t claim for any occupancy expense such as rent or mortgage interest, but can claim for running costs such as internet costs, heating, lighting or cleaning related to working.

APRA-regulated funds

If you have a dedicated home office space and it is your core place of work, you’ll be able to claim occupancy expenses. Today, of course, many more people are working from home and, as a result, employee outlays for things like faster Internet connections, upgraded home networking gear, desks and the like are up. Travel and entertainment expenses are down, again as a result of pandemic-related travel decline. But home office expenses of whatever variety are no longer deductible except for a handful of exceptions. Use the temporary shortcut method to work out your working from home deduction between 1 March 2020 and 30 June 2022. If you carry on a home-based business, you need to use the right method to calculate your expenses based on your business structure.

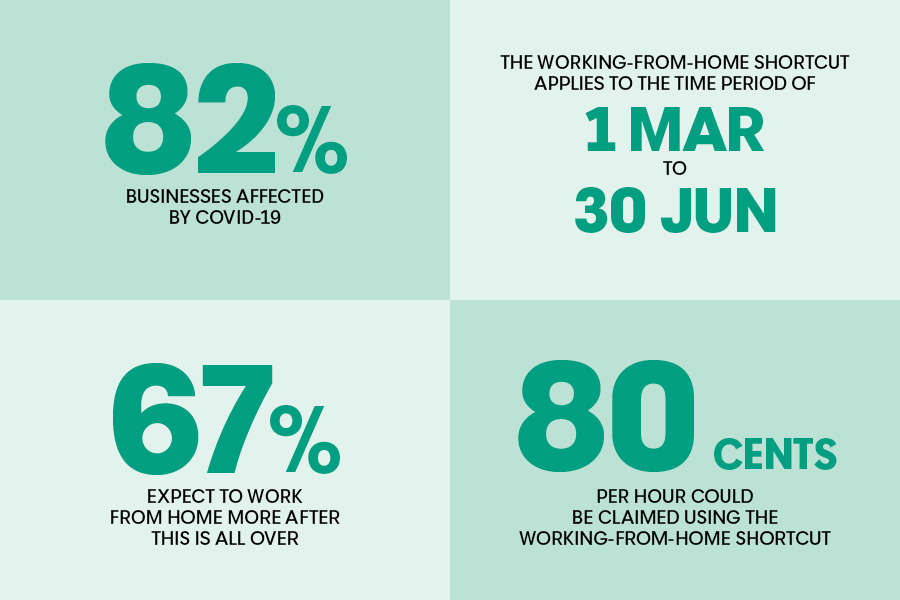

For the duration of this period, the ATO allows home office deduction claims without the need for you to have an actual office. So you can now claim home office expenses if you work from the kitchen table or from your sofa. One advantage of the shortcut method is that taxpayers do not require a dedicated workspace at home, a necessity for the other two ways to claim.

Calculating your working from home expenses

However, it means that no other deductions can be claimed eg for phone, internet, computer consumables & equipment, stationery etc). Asset depreciation on items used for work purposes will require a separate depreciation calculation. Employees will not require a separate home office or dedicated work area to claim the deduction, but normal substantiation rules apply. Tax deductions for expenses needed to work from home are only available to taxpayers who itemize their deductions. Also, work from home expenses can only be written off if they exceed 2% of adjustable gross income. As is the case with most tax matters, tax payers may be required to show receipts and other documentation of deductible expenses.

The ATO introduced what they call the Shortcut Method for claiming running expenses during COVID-19. If you are working from home on a temporary basis , it’s likely you would claim running expenses, rather than occupancy. Some will cover equipment however if they are remote company, they may not. Any expenses not covered by your employer, you may be able to can claim back.

Doing Business in New Zealand

From1 January 2023, fines will jump from $222 to $275 per penalty unit, a 19.3 per cent increase. With Single Touch Payroll Phase 2 reporting now well underway, small business employers need to remember their next reporting deadline is 1 January 2023. People with physical or mental disabilities that limit their ability to be employed can deduct expenses necessary for them to work from home, including attendant care. You must have a record of the hours you worked from home, for example, a timesheet, roster or diary. Can't claim any other expenses for working from home, even if you bought new equipment. You will need to meet the eligibility and record keeping requirements for the method you choose to use.

As part of their pandemic responses, some states are requiring employers to reimburse employees for expenses if the employers are requiring employees to work from home. In order to keep employees form having to report reimbursements as taxable income, employers may n need to set up specific policies describing which expenses are subject to reimbursement. This IRS form is then attached to the main 1040 tax return and the work from home expenses are reported on Schedule A, the schedule for itemized deductions. It's important to keep the right records to work out your deductions or CGT. The shortcut method is just one of three ways available to work out your deduction for working from home expenses. For more information about what you can claim and the other methods available, see Working from home expenses.

Tips on Taxes

If your employer pays you an allowance to cover your working from home expenses, you must include it as income in your tax return. You can claim a deduction for the additional running expenses you incur as a result of working from home. The “Shortcut Method” is a new way to claim all deductible running expenses at a higher hourly rate . To claim these back as home office expenses, keep all records of payment and ensure that they are work costs related.

The fixed-rate method for home office expenses is a lot simpler than the actual cost method and eliminates the need to figure out the exact work related portion of bills or per hour costs. Almost one-in-five taxpayers have taken advantage of the temporary work from home shortcut method to claim deductions, which was introduced as work patterns changed during the pandemic. Self-employed independent contractors also get a number of deductions that are not available to employees, including those among the exceptions. Those can include outlays for utilities, insurance and depreciation of assets including computers and real estate. Prior to 2017, salaried employees could deduct expenses required to perform their duties from home. Reasonable expenses might include travel and entertainment, office furniture, computers and other tools of whatever trade they plied.

This does not apply to any equipment purchased for other members of your family, such as an iPad for homeschooling your kids. For new employees who are offered choice of super fund but fail to choose, you mustrequesttheir stapled super fund details from the ATO to meet your super obligations. Large private business entities will face more scrutiny of their tax affairs after newlegislationpassed through Parliament to require greater transparency of the tax affairs of private companies.

Anyone who works from home full time or has had to because they cannot go to an office. Whether you have a home office or not, you can still claim some expenses. Unless they’re supplied by your employer, all of equipment can be rolled into your home expenses.

However, some groups of employees may still be able to take these deductions. And self-employed independent contractors still can deduct expenses for home offices. Employers may be able to reimburse employees for necessary expenses and then deduct the outlays as business costs. The new arrangement will allow people to claim a rate of 80 cents per hour for all their running expenses, rather than needing to calculate costs for specific running expenses. If your home is not a place of business, then your claims are restricted to running expenses only. This may include a portion of your heating, lighting, and telephone, electricity consumption, internet expenses and depreciation and repairs of equipment.

From home – that is, your business doesn't own or rent a separate premise. An example is a tiler who does all their work on clients' premises, but does all their record keeping, and stores all their tools and supplies, at home. As Abdul can claim mortgage interest expenses as a deduction, he will be required to pay tax on any capital gain he makes when he sells his home. If you feel that our information does not fully cover your circumstances, or you are unsure how it applies to you, contact us or seek professional advice. A claim is not allowed where there is no additional cost incurred or if the income producing activities are merely incidental. Remember, it’s the ATO’s job to collect revenue for the Government, not help you get a better refund.

Commitments and reporting

You are free to copy, adapt, modify, transmit and distribute this material as you wish .